Locked-In Effect: 7% Rates Are Keeping The Housing Market In Check

|

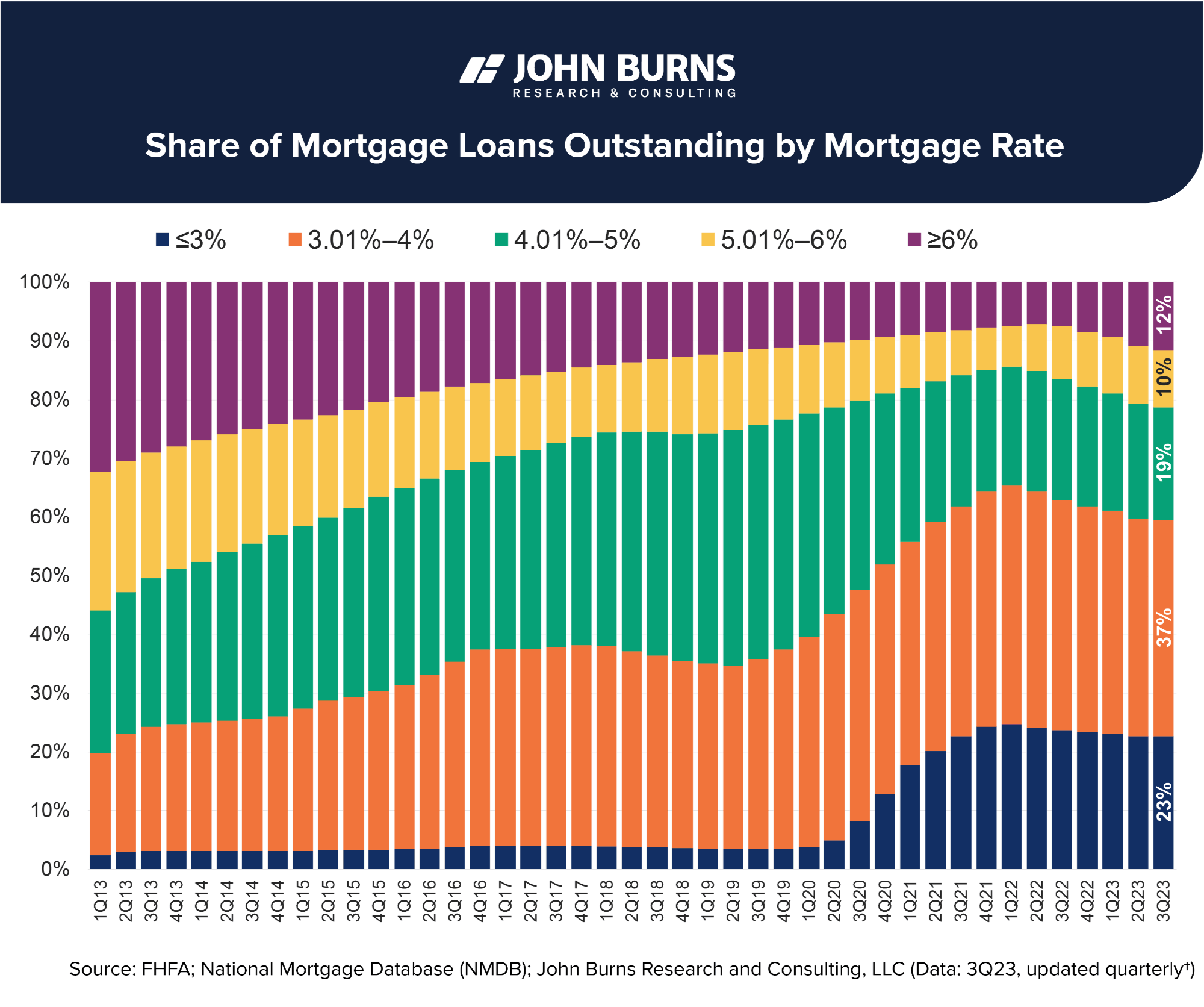

As we approach April, mortgage rates remain high at 7% - Buyer Demand is at an all-time high even though affordability issues persist. In many ways, the economy stands strong (yet there are also signs that we are in a recession). While the Fed hesitates to cut interest rates, it is still predicted a slight rate cut could occur in June. Resale inventory is slowing growing. The lock-in effect is when homeowners are “locked in” and unwilling to give up their sub-6% mortgage rates. Builders still have the edge, but rising resale inventory could erode their advantage. The inventory of existing homes for sale, while still near historic lows, has grown +2% since this time last year. The housing market is well past the peak lock-in days of early 2022, when 92% of borrowers had a rate below 6% - now the actual number is likely closer to 85% today based on trends. Millions of borrowers are no longer locked in, which will only grow as rates stay high and homes take longer to sell. |

|

|

Credit: John Burns Research and Consulting

Categories

Recent Posts